PAXG Token Overview: What Is PAX Gold and Is PAXG Crypto Worth Investing In?

As digital assets continue to evolve, tokenized real-world assets (RWAs) are becoming a key bridge between traditional finance and blockchain markets. Among these, PAX Gold (PAXG) stands out as one of the most established and regulated gold-backed crypto assets, offering investors direct exposure to physical gold through a blockchain-based structure.

This article explores what is PAX Gold, how the PAXG token works within Paxos’ broader tokenization strategy, how it compares with traditional gold investments, how the PAX gold price tracks physical gold, and whether PAXG is worth investing in. It also explains how to buy and trade PAX Gold efficiently through WEEX PAXG markets.

What Is PAX Gold (PAXG)?

PAX Gold (PAXG) is a regulated, asset-backed digital token issued by Paxos Trust Company, a New York State–chartered trust company regulated by the New York Department of Financial Services (NYDFS).

Each PAXG token represents one fine troy ounce of physical gold, stored in LBMA-accredited vaults in London. The underlying gold takes the form of 400-ounce “Good Delivery” bars held in Brink’s vaults. Token holders have direct, legally enforceable ownership rights to specific gold bars, with allocation details verifiable on-chain.

For investors asking what is PAX gold?, the key distinction is that PAXG is not a synthetic or derivative product. It is fully backed by allocated physical gold, with monthly attestation reports published by Withum and made publicly available through Paxos.

PAXG and Paxos’ Tokenization Strategy

PAX Gold plays a central role in Paxos’ broader tokenization strategy, which focuses on bringing traditional financial assets on-chain in a compliant and transparent manner. Paxos is also the issuer of regulated stablecoins and provides settlement infrastructure for institutional clients.

Through the PAXG token, Paxos demonstrates how physical commodities such as gold can be digitized, fractionalized, and traded globally while remaining within established regulatory frameworks. This approach has made PAX Gold particularly attractive to institutions, professional traders, and regulators seeking compliant exposure to tokenized assets.

In 2025, amid increased U.S. regulatory scrutiny of stablecoins and asset-backed tokens, Paxos continued to be referenced in policy discussions due to its full-reserve model and transparent audit framework. PAX Gold has been cited in regulatory commentary as a compliant example of tokenized gold.

PAX Gold vs Traditional Gold Investment

Compared with physical gold and gold ETFs, PAX Gold offers a distinct structural profile:

Aspect | Physical Gold | Gold ETFs | PAXG Token |

Ownership | Direct | Indirect | Direct |

Storage | Self-managed | Managed by issuer | Institutional vaults |

Trading Hours | Limited | Market hours | 24/7 |

Fractional Trading | No | Limited | Yes |

On-chain Transparency | No | No | Yes |

PAXG removes the operational friction associated with physical gold storage while avoiding the indirect exposure common in ETF structures. By settling on blockchain infrastructure, the PAXG token allows continuous trading and near-instant transferability without sacrificing physical backing.

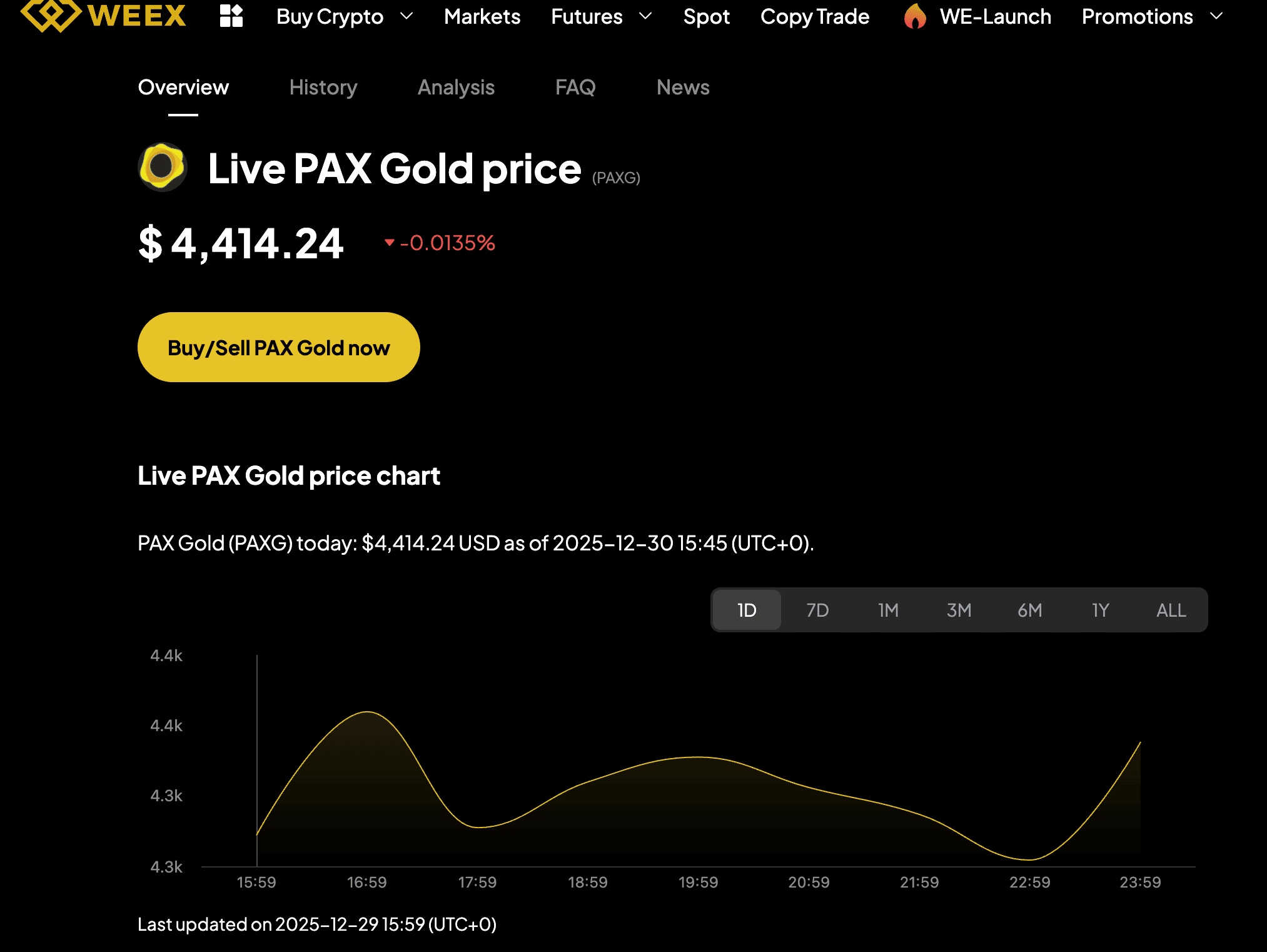

PAX Gold Price and PAXG Coin vs Gold Price

The PAX gold price is designed to closely track the global spot price of gold, as each PAXG token is backed by one fine troy ounce of physical gold. In practice, small deviations between the PAXG coin vs gold price can occur due to exchange liquidity conditions, transaction costs, and short-term demand fluctuations.

As of late 2025, PAX Gold’s total market capitalization surpassed 1.6 billion USD, with prices moving in line with spot gold as it traded above the 4,500 USD per ounce range. These dynamics reinforce PAXG’s role as a digital representation of gold rather than a speculative proxy.

Over time, pricing discrepancies tend to remain limited, making the PAXG token a reliable instrument for gold exposure within crypto markets.

Is PAX Gold a Good Investment?

Whether PAX Gold is a good investment depends on an investor’s objectives and risk profile. PAXG is commonly used as a portfolio stabilizer, an inflation hedge, and a diversification tool within crypto-native portfolios.

Key considerations include:

- Regulatory strength, supported by NYDFS oversight and monthly audits

- On-chain transparency and verifiable physical backing

- Liquidity across centralized and decentralized venues

- Exposure to macro-driven gold price volatility

By the end of 2025, on-chain and derivatives data showed increasing institutional engagement. Exchange hot wallets held approximately 920,000 ounces, representing around 74 percent of circulating supply. Derivatives markets reflected moderate bullish sentiment toward gold, while cross-chain flows to Solana-based liquidity pools indicated growing demand for yield-generating strategies using PAXG.

However, investors should also consider redemption fees and broader macroeconomic factors affecting gold prices when evaluating long-term holding strategies.

How to Buy Paxos Gold (PAXG) on WEEX

WEEX provides a centralized trading environment designed to support efficient execution and risk management for asset-backed tokens such as PAX Gold.

To trade WEEX PAXG markets, users typically follow these steps:

- Create an Account: Sign up for a WEEX account by logging in the official website.

- Complete Verification: Secure your account by completing the necessary identity verification steps.

- Deposit Funds: Add funds using your preferred payment method.

- Search for PAXG Coin: Use the search function to find PAXG/USDT on WEEX.

- Place Your Order: Select the amount of PAXG token you want to buy and submit your order.

- Confirm Purchase: Review your details and confirm the purchase.

WEEX integrates advanced risk control systems and deep liquidity support from leading liquidity providers, enabling efficient access to the PAXG token without the complexities of physical gold custody.

Conclusion: PAX Gold and WEEX as a Digital Gold Trading Solution

PAX Gold represents one of the most mature implementations of tokenized gold, combining physical backing, regulatory oversight, and blockchain efficiency. For investors exploring what is PAX gold?, tracking the PAX gold price, or evaluating PAXG coin vs gold price dynamics, PAXG offers a transparent and institution-ready solution.

When traded through WEEX PAXG markets, investors gain access to professional-grade infrastructure, strong liquidity, and reliable execution. Together, PAX Gold and WEEX provide a practical framework for integrating gold exposure into modern crypto portfolios.

You may also like

Cardano (ADA) 2026: Is Cardano Finally Delivering in 2026? A Roadmap of Leios, Midnight, and Voltaire

Cardano 2026 explained: Ouroboros Leios, Midnight NIGHT, governance, and ADA price prediction. A deep analysis of scaling, privacy, and long-term adoption.

Can I Invest in Silver 2026? Is It Too Late to Invest in Silver?

As silver prices surge past $120 per ounce in early 2026, reaching all-time highs and outperforming gold by significant margins, investors worldwide are asking the same urgent question: "Is it too late to invest in silver?" This comprehensive guide examines whether silver still presents a compelling investment opportunity in 2026, analyzing the powerful fundamental forces driving prices higher and providing actionable insights for both new and experienced investors.

Introducing Warden: Complete Guide to $WARD and Airdrop Opportunities

Warden Protocol is a blockchain infrastructure project built to enable the agent economy. Warden enables secure, interoperable AI agents to operate across multiple blockchains, simplifying liquidity, data, and cross-chain access for Web3 developers and users. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 Warden airdrop before Feb.11, 2026!

WEEX vs Other Exchanges: 2026 Liquidity and Fees Comparison - Which is Best?

Unlike many exchanges that struggle with fragmented liquidity pools, WEEX has implemented strategic partnerships with institutional market makers and maintains deep liquidity reserves across all major trading pairs. The platform's 1700+ supported assets aren't just listed—they're actively traded with institutional-grade depth that ensures consistent execution quality.

What Is Copy Trading? Your Complete Guide to Getting Started in Crypto

Copy trading has surged in popularity within the crypto world, especially as platforms like WEEX integrate it seamlessly…

How Does an ETF Work? Your Essential Guide to Exchange-Traded Funds in Crypto and Beyond

Exchange-traded funds, or ETFs, have surged in popularity lately, especially with the 2024 approvals of spot Bitcoin ETFs…

What is BORT Coin (BORT)?

Cryptocurrency enthusiasts have something new to explore on WEEX Exchange: the listing of BORT Coin (BORT) paired with…

BORT USDT Premieres on WEEX: BORT Coin Exclusive Listing

WEEX Exchange is thrilled to announce the world premiere listing of BORT Coin (BORT), an innovative token empowering…

What is Liora Nuclear Beam (BEAM) Coin?

We are thrilled to announce that the BEAM/USDT trading pair is now available on WEEX, with trading commencing…

BEAM USDT Exclusive Debut on WEEX: Liora Nuclear Beam (BEAM) Listing

WEEX Exchange is thrilled to announce the exclusive world premiere listing of Liora Nuclear Beam (BEAM) Coin, powering…

What is Rentahuman (RENT) Coin?

We’re excited to announce the listing of Rentahuman (RENT) on WEEX, a cutting-edge token that is now available…

RENT USDT Debuts on WEEX: rentahuman (RENT) Coin World Premiere

WEEX Exchange proudly announces the world premiere listing of rentahuman (RENT) Coin, with RENT USDT trading now live…

What is Spot DCA? Your Essential Guide to Smarter Crypto Investing in Volatile Markets

As of February 4, 2026, the crypto market continues to show its unpredictable side, with Bitcoin hovering around…

Where Will Bitcoin Go in 2026? Expert Price Predictions and Market Outlook

Bitcoin has kicked off 2026 on a shaky note, with its price dipping to around $77,500 as of…

What Is Liquidation in Crypto? Essential Guide for Traders to Manage Risks and Avoid Losses

As of February 4, 2026, the crypto market continues to grapple with high volatility, with Bitcoin experiencing a…

BORT Coin Price Prediction & Forecasts for February 2026: Could This New AI Agent Token Surge 50% Amid BSC Ecosystem Growth?

BORT Coin has just made waves with its fresh listing on WEEX Exchange, launching BORT/USDT trading on February…

Liora Nuclear Beam (BEAM) Coin Price Prediction & Forecasts for February 2026 – Could It Rally 50% Amid New Listings?

The Liora Nuclear Beam (BEAM) coin has just made waves in the crypto space with its fresh listing…

rentahuman (RENT) Coin Price Prediction & Forecasts for February 2026 – Fresh Listing Sparks Potential Rally

The rentahuman (RENT) coin has just hit the market today, February 4, 2026, with trading kicking off on…

Cardano (ADA) 2026: Is Cardano Finally Delivering in 2026? A Roadmap of Leios, Midnight, and Voltaire

Cardano 2026 explained: Ouroboros Leios, Midnight NIGHT, governance, and ADA price prediction. A deep analysis of scaling, privacy, and long-term adoption.

Can I Invest in Silver 2026? Is It Too Late to Invest in Silver?

As silver prices surge past $120 per ounce in early 2026, reaching all-time highs and outperforming gold by significant margins, investors worldwide are asking the same urgent question: "Is it too late to invest in silver?" This comprehensive guide examines whether silver still presents a compelling investment opportunity in 2026, analyzing the powerful fundamental forces driving prices higher and providing actionable insights for both new and experienced investors.

Introducing Warden: Complete Guide to $WARD and Airdrop Opportunities

Warden Protocol is a blockchain infrastructure project built to enable the agent economy. Warden enables secure, interoperable AI agents to operate across multiple blockchains, simplifying liquidity, data, and cross-chain access for Web3 developers and users. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 Warden airdrop before Feb.11, 2026!

WEEX vs Other Exchanges: 2026 Liquidity and Fees Comparison - Which is Best?

Unlike many exchanges that struggle with fragmented liquidity pools, WEEX has implemented strategic partnerships with institutional market makers and maintains deep liquidity reserves across all major trading pairs. The platform's 1700+ supported assets aren't just listed—they're actively traded with institutional-grade depth that ensures consistent execution quality.

What Is Copy Trading? Your Complete Guide to Getting Started in Crypto

Copy trading has surged in popularity within the crypto world, especially as platforms like WEEX integrate it seamlessly…

How Does an ETF Work? Your Essential Guide to Exchange-Traded Funds in Crypto and Beyond

Exchange-traded funds, or ETFs, have surged in popularity lately, especially with the 2024 approvals of spot Bitcoin ETFs…

Earn

Earn