MicroStrategy Pauses Bitcoin Buys Amidst Massive Equity Offering Push

The crypto world’s most prominent Bitcoin accumulator, MicroStrategy, has signaled a shift in its immediate strategy, opting to pause its Bitcoin acquisition activities last week. This move coincides with a significant push to bolster its capital through a substantially upsized equity offering, redirecting focus and resources.

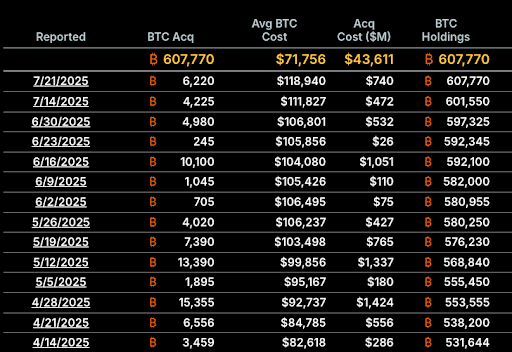

As the world’s largest public holder of Bitcoin, MicroStrategy reported no new Bitcoin purchases in the past week. This decision comes despite the digital asset experiencing notable volatility and testing new all-time highs mid-July. The company’s substantial Bitcoin holdings remained unchanged at 607,770 BTC as of last Monday, according to a filing with the U.S. Securities and Exchange Commission (SEC).

Interestingly, the pause in MicroStrategy’s buying did not deter Bitcoin’s upward momentum. The cryptocurrency saw its price climb from approximately $118,000 to over $119,000 throughout the week. This resilience occurred even amidst MicroStrategy’s inactivity and reports of an 80,000 BTC sale by an early investor on Friday, according to CoinGecko data.

July Bitcoin Acquisitions Plummet 39% Month-Over-Month

Last week’s hiatus highlights a broader trend of decelerated buying activity for MicroStrategy throughout July. The company documented just two Bitcoin acquisitions for the month: a purchase of 4,225 BTC on July 14th and another 6,220 BTC on July 21st, totaling 10,445 BTC. This figure represents a significant 39% drop compared to the 17,075 BTC acquired in June.

The acquisition pace in prior months was even more robust, with purchases of 26,695 BTC in May and 25,370 BTC in April. Prior to skipping buys in the first week of July, MicroStrategy had previously reported no purchases in the first week of April as well.

The company bought even more Bitcoin in the previous months, reporting purchases of 26,695 BTC in May and 25,370 BTC in April.

Prior to skipping the buy in the first week of July, Strategy previously reported no buys in the first week of April.

Upsized STRC Offering Signals Strategic Capital Reallocation

The slowdown in MicroStrategy’s Bitcoin purchasing strategy directly correlates with its aggressive capital raising efforts. Last Friday, the company announced it had upsized its Series A perpetual stretch preferred stock (STRC) offering to an impressive $2.521 billion, a substantial increase from its initially planned $500 million.

Priced at $90 per share, the issuance and sale are slated to settle on Tuesday, subject to customary closing conditions.

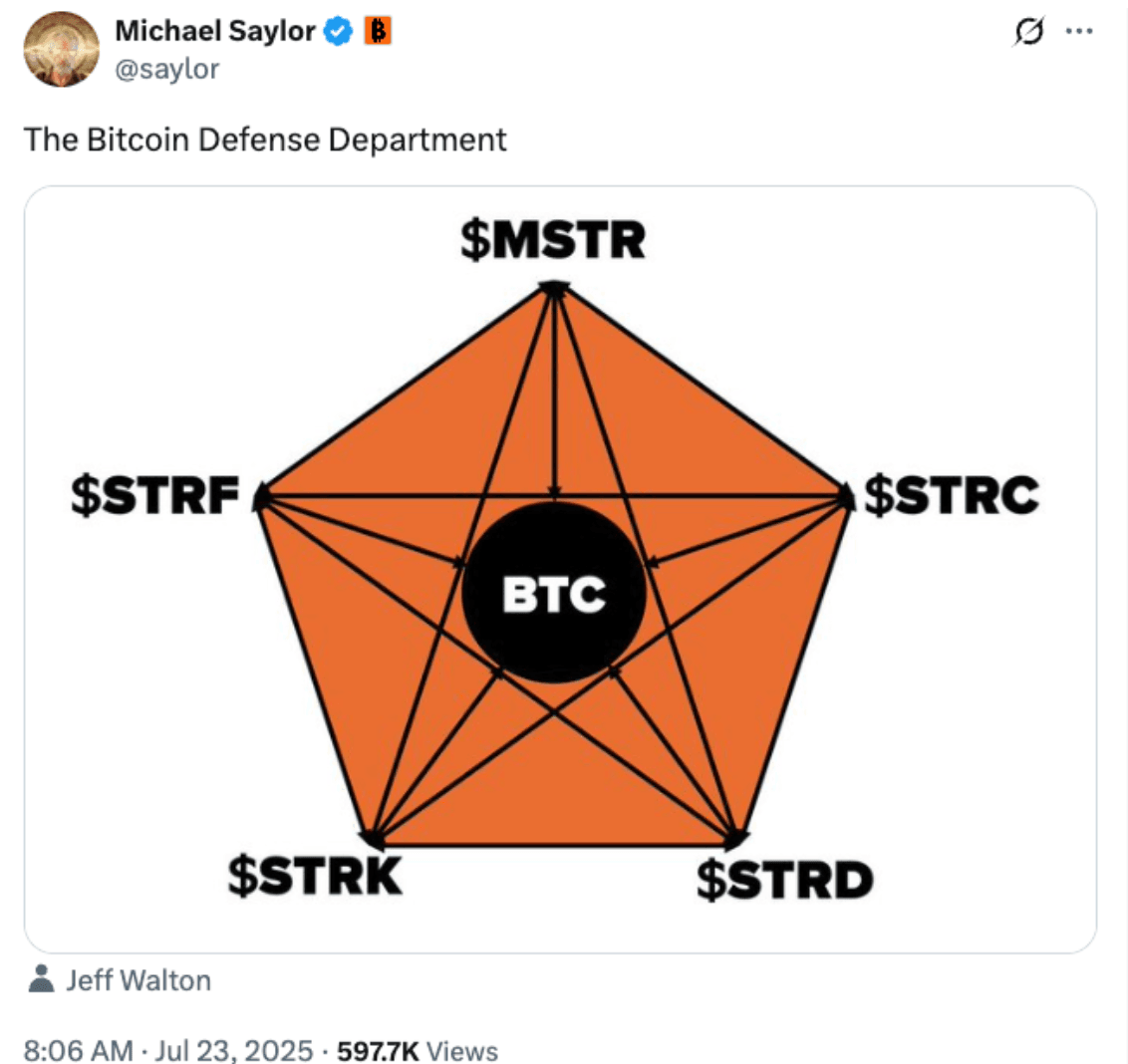

Similar to four previous MicroStrategy offerings, including the Series A perpetual strike preferred stock (STRK), the new STRC program functions as an equity-raising mechanism. Its core purpose is to empower the company to gradually sell newly issued shares, thereby generating capital to continue its Bitcoin accumulation strategy.

Michael Saylor, MicroStrategy’s co-founder, took to X (formerly Twitter) on Wednesday to refer to STRC as one of the four pillars of the company’s “Bitcoin defense department.” This statement underscores the strategic importance of this financing round in supporting MicroStrategy’s long-term commitment to Bitcoin, even as its immediate purchasing cadence adjusts.

You may also like

Cardano (ADA) 2026: Is Cardano Finally Delivering in 2026? A Roadmap of Leios, Midnight, and Voltaire

Cardano 2026 explained: Ouroboros Leios, Midnight NIGHT, governance, and ADA price prediction. A deep analysis of scaling, privacy, and long-term adoption.

Can I Invest in Silver 2026? Is It Too Late to Invest in Silver?

As silver prices surge past $120 per ounce in early 2026, reaching all-time highs and outperforming gold by significant margins, investors worldwide are asking the same urgent question: "Is it too late to invest in silver?" This comprehensive guide examines whether silver still presents a compelling investment opportunity in 2026, analyzing the powerful fundamental forces driving prices higher and providing actionable insights for both new and experienced investors.

Introducing Warden: Complete Guide to $WARD and Airdrop Opportunities

Warden Protocol is a blockchain infrastructure project built to enable the agent economy. Warden enables secure, interoperable AI agents to operate across multiple blockchains, simplifying liquidity, data, and cross-chain access for Web3 developers and users. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 Warden airdrop before Feb.11, 2026!

WEEX vs Other Exchanges: 2026 Liquidity and Fees Comparison - Which is Best?

Unlike many exchanges that struggle with fragmented liquidity pools, WEEX has implemented strategic partnerships with institutional market makers and maintains deep liquidity reserves across all major trading pairs. The platform's 1700+ supported assets aren't just listed—they're actively traded with institutional-grade depth that ensures consistent execution quality.

What Is Copy Trading? Your Complete Guide to Getting Started in Crypto

Copy trading has surged in popularity within the crypto world, especially as platforms like WEEX integrate it seamlessly…

How Does an ETF Work? Your Essential Guide to Exchange-Traded Funds in Crypto and Beyond

Exchange-traded funds, or ETFs, have surged in popularity lately, especially with the 2024 approvals of spot Bitcoin ETFs…

What is BORT Coin (BORT)?

Cryptocurrency enthusiasts have something new to explore on WEEX Exchange: the listing of BORT Coin (BORT) paired with…

BORT USDT Premieres on WEEX: BORT Coin Exclusive Listing

WEEX Exchange is thrilled to announce the world premiere listing of BORT Coin (BORT), an innovative token empowering…

What is Liora Nuclear Beam (BEAM) Coin?

We are thrilled to announce that the BEAM/USDT trading pair is now available on WEEX, with trading commencing…

BEAM USDT Exclusive Debut on WEEX: Liora Nuclear Beam (BEAM) Listing

WEEX Exchange is thrilled to announce the exclusive world premiere listing of Liora Nuclear Beam (BEAM) Coin, powering…

What is Rentahuman (RENT) Coin?

We’re excited to announce the listing of Rentahuman (RENT) on WEEX, a cutting-edge token that is now available…

RENT USDT Debuts on WEEX: rentahuman (RENT) Coin World Premiere

WEEX Exchange proudly announces the world premiere listing of rentahuman (RENT) Coin, with RENT USDT trading now live…

What is Spot DCA? Your Essential Guide to Smarter Crypto Investing in Volatile Markets

As of February 4, 2026, the crypto market continues to show its unpredictable side, with Bitcoin hovering around…

Where Will Bitcoin Go in 2026? Expert Price Predictions and Market Outlook

Bitcoin has kicked off 2026 on a shaky note, with its price dipping to around $77,500 as of…

What Is Liquidation in Crypto? Essential Guide for Traders to Manage Risks and Avoid Losses

As of February 4, 2026, the crypto market continues to grapple with high volatility, with Bitcoin experiencing a…

BORT Coin Price Prediction & Forecasts for February 2026: Could This New AI Agent Token Surge 50% Amid BSC Ecosystem Growth?

BORT Coin has just made waves with its fresh listing on WEEX Exchange, launching BORT/USDT trading on February…

Liora Nuclear Beam (BEAM) Coin Price Prediction & Forecasts for February 2026 – Could It Rally 50% Amid New Listings?

The Liora Nuclear Beam (BEAM) coin has just made waves in the crypto space with its fresh listing…

rentahuman (RENT) Coin Price Prediction & Forecasts for February 2026 – Fresh Listing Sparks Potential Rally

The rentahuman (RENT) coin has just hit the market today, February 4, 2026, with trading kicking off on…

Cardano (ADA) 2026: Is Cardano Finally Delivering in 2026? A Roadmap of Leios, Midnight, and Voltaire

Cardano 2026 explained: Ouroboros Leios, Midnight NIGHT, governance, and ADA price prediction. A deep analysis of scaling, privacy, and long-term adoption.

Can I Invest in Silver 2026? Is It Too Late to Invest in Silver?

As silver prices surge past $120 per ounce in early 2026, reaching all-time highs and outperforming gold by significant margins, investors worldwide are asking the same urgent question: "Is it too late to invest in silver?" This comprehensive guide examines whether silver still presents a compelling investment opportunity in 2026, analyzing the powerful fundamental forces driving prices higher and providing actionable insights for both new and experienced investors.

Introducing Warden: Complete Guide to $WARD and Airdrop Opportunities

Warden Protocol is a blockchain infrastructure project built to enable the agent economy. Warden enables secure, interoperable AI agents to operate across multiple blockchains, simplifying liquidity, data, and cross-chain access for Web3 developers and users. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 Warden airdrop before Feb.11, 2026!

WEEX vs Other Exchanges: 2026 Liquidity and Fees Comparison - Which is Best?

Unlike many exchanges that struggle with fragmented liquidity pools, WEEX has implemented strategic partnerships with institutional market makers and maintains deep liquidity reserves across all major trading pairs. The platform's 1700+ supported assets aren't just listed—they're actively traded with institutional-grade depth that ensures consistent execution quality.

What Is Copy Trading? Your Complete Guide to Getting Started in Crypto

Copy trading has surged in popularity within the crypto world, especially as platforms like WEEX integrate it seamlessly…

How Does an ETF Work? Your Essential Guide to Exchange-Traded Funds in Crypto and Beyond

Exchange-traded funds, or ETFs, have surged in popularity lately, especially with the 2024 approvals of spot Bitcoin ETFs…

Earn

Earn