Bitcoin Surges Towards $120K, Analysts Foresee Heightened Volatility Ahead

Bitcoin has staged a dramatic late-week rally, propelling it towards the crucial $120,000 resistance level as the weekly close approaches. Market participants are bracing for potentially larger price swings, with key liquidation zones and significant trading behavior dominating analyst discussions.

Key Takeaways:

- BTC exhibits a strong late-week comeback, targeting significant liquidation zones and aiming to retake critical price areas.

- Traders and analysts highlight specific price points that Bitcoin must conquer to sustain upward momentum.

- Volatility is expected based on large-volume trading behavior, analysis reports.

Bitcoin Volatility Surges as Weekly Close Looms

Data reveals Bitcoin’s determined ascent, now approaching a pivotal resistance zone. The BTC/USD trading pair is attempting to secure a daily close above its 10-day Simple Moving Average (SMA). This rebound, stemming from lows near $114,500, marks a significant recovery, seemingly overshadowing the memory of one of the largest Bitcoin sales in history.

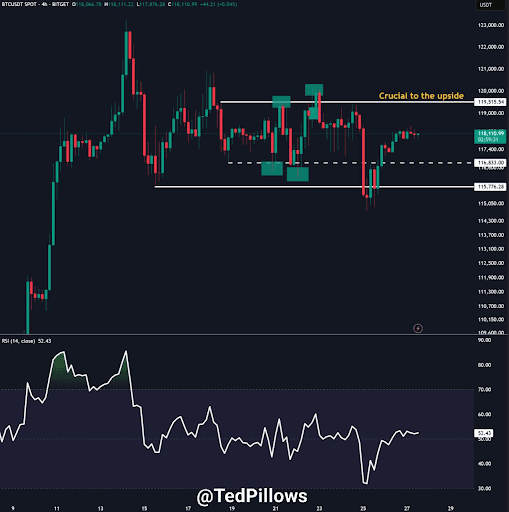

Crypto investor and entrepreneur Ted Pillows commented on X, stating, “$BTC needs to break above $119.5K for a big move. If that doesn’t happen, this consolidation will continue. I think BTC could break above this level next month, which will start the next leg up.”

“$BTC needs to break above $119.5K for a big move. If that doesn't happen, this consolidation will continue,” crypto investor and entrepreneur Ted Pillows summarized in a post on X.

“I think BTC could break above this level next month which will start the next leg up.”

Popular trader and analyst Rekt Capital eyed a slightly higher range ceiling just below the $120,000 mark.

“Bitcoin has Daily Closed above the blue Range Low, kickstarting a break back into the very briefly lost Range,” he told X followers alongside a print of the daily BTC/USD chart.

“Any dips into the Range Low (confluent with the new Higher Low) would be a retest attempt to confirm the reclaim.”

Others warned that price could still fill the daily downside wick left by the trip to $114,500.

In an X thread on the topic, fellow trader CrypNuevo identified a downside target confluent with an area of exchange order-book liquidity.

“If we zoom out, we can see that the main liquidation level is at $113.8k,” he commented.

“Larger Price Swings” Predicted as Liquidation Levels Come into Focus

Recent data places the “max pain” for Bitcoin shorts at approximately $119,650. Should Bitcoin push towards challenging all-time highs near $123,000, short liquidations could exceed a staggering $1.1 billion.

Crypto analysis platform Coinank, examining its own liquidity data, concurred with the resistance: “Strong resistance forming around 119,000–120,000, indicated by dense liquidation clusters.”

Analyst TheKingfisher further highlighted the potential for amplified volatility on shorter timeframes. Reporting on X on Sunday, they observed, “Seeing predominantly red on the BTC GEX+ chart. This indicates dealers are heavily short gamma, suggesting they may amplify volatility to hedge their positions.”

You may also like

Cardano (ADA) 2026: Is Cardano Finally Delivering in 2026? A Roadmap of Leios, Midnight, and Voltaire

Cardano 2026 explained: Ouroboros Leios, Midnight NIGHT, governance, and ADA price prediction. A deep analysis of scaling, privacy, and long-term adoption.

Can I Invest in Silver 2026? Is It Too Late to Invest in Silver?

As silver prices surge past $120 per ounce in early 2026, reaching all-time highs and outperforming gold by significant margins, investors worldwide are asking the same urgent question: "Is it too late to invest in silver?" This comprehensive guide examines whether silver still presents a compelling investment opportunity in 2026, analyzing the powerful fundamental forces driving prices higher and providing actionable insights for both new and experienced investors.

Introducing Warden: Complete Guide to $WARD and Airdrop Opportunities

Warden Protocol is a blockchain infrastructure project built to enable the agent economy. Warden enables secure, interoperable AI agents to operate across multiple blockchains, simplifying liquidity, data, and cross-chain access for Web3 developers and users. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 Warden airdrop before Feb.11, 2026!

WEEX vs Other Exchanges: 2026 Liquidity and Fees Comparison - Which is Best?

Unlike many exchanges that struggle with fragmented liquidity pools, WEEX has implemented strategic partnerships with institutional market makers and maintains deep liquidity reserves across all major trading pairs. The platform's 1700+ supported assets aren't just listed—they're actively traded with institutional-grade depth that ensures consistent execution quality.

What Is Copy Trading? Your Complete Guide to Getting Started in Crypto

Copy trading has surged in popularity within the crypto world, especially as platforms like WEEX integrate it seamlessly…

How Does an ETF Work? Your Essential Guide to Exchange-Traded Funds in Crypto and Beyond

Exchange-traded funds, or ETFs, have surged in popularity lately, especially with the 2024 approvals of spot Bitcoin ETFs…

What is BORT Coin (BORT)?

Cryptocurrency enthusiasts have something new to explore on WEEX Exchange: the listing of BORT Coin (BORT) paired with…

BORT USDT Premieres on WEEX: BORT Coin Exclusive Listing

WEEX Exchange is thrilled to announce the world premiere listing of BORT Coin (BORT), an innovative token empowering…

What is Liora Nuclear Beam (BEAM) Coin?

We are thrilled to announce that the BEAM/USDT trading pair is now available on WEEX, with trading commencing…

BEAM USDT Exclusive Debut on WEEX: Liora Nuclear Beam (BEAM) Listing

WEEX Exchange is thrilled to announce the exclusive world premiere listing of Liora Nuclear Beam (BEAM) Coin, powering…

What is Rentahuman (RENT) Coin?

We’re excited to announce the listing of Rentahuman (RENT) on WEEX, a cutting-edge token that is now available…

RENT USDT Debuts on WEEX: rentahuman (RENT) Coin World Premiere

WEEX Exchange proudly announces the world premiere listing of rentahuman (RENT) Coin, with RENT USDT trading now live…

What is Spot DCA? Your Essential Guide to Smarter Crypto Investing in Volatile Markets

As of February 4, 2026, the crypto market continues to show its unpredictable side, with Bitcoin hovering around…

Where Will Bitcoin Go in 2026? Expert Price Predictions and Market Outlook

Bitcoin has kicked off 2026 on a shaky note, with its price dipping to around $77,500 as of…

What Is Liquidation in Crypto? Essential Guide for Traders to Manage Risks and Avoid Losses

As of February 4, 2026, the crypto market continues to grapple with high volatility, with Bitcoin experiencing a…

BORT Coin Price Prediction & Forecasts for February 2026: Could This New AI Agent Token Surge 50% Amid BSC Ecosystem Growth?

BORT Coin has just made waves with its fresh listing on WEEX Exchange, launching BORT/USDT trading on February…

Liora Nuclear Beam (BEAM) Coin Price Prediction & Forecasts for February 2026 – Could It Rally 50% Amid New Listings?

The Liora Nuclear Beam (BEAM) coin has just made waves in the crypto space with its fresh listing…

rentahuman (RENT) Coin Price Prediction & Forecasts for February 2026 – Fresh Listing Sparks Potential Rally

The rentahuman (RENT) coin has just hit the market today, February 4, 2026, with trading kicking off on…

Cardano (ADA) 2026: Is Cardano Finally Delivering in 2026? A Roadmap of Leios, Midnight, and Voltaire

Cardano 2026 explained: Ouroboros Leios, Midnight NIGHT, governance, and ADA price prediction. A deep analysis of scaling, privacy, and long-term adoption.

Can I Invest in Silver 2026? Is It Too Late to Invest in Silver?

As silver prices surge past $120 per ounce in early 2026, reaching all-time highs and outperforming gold by significant margins, investors worldwide are asking the same urgent question: "Is it too late to invest in silver?" This comprehensive guide examines whether silver still presents a compelling investment opportunity in 2026, analyzing the powerful fundamental forces driving prices higher and providing actionable insights for both new and experienced investors.

Introducing Warden: Complete Guide to $WARD and Airdrop Opportunities

Warden Protocol is a blockchain infrastructure project built to enable the agent economy. Warden enables secure, interoperable AI agents to operate across multiple blockchains, simplifying liquidity, data, and cross-chain access for Web3 developers and users. Learn its tokenomics, ecosystem impact, and how to claim free tokens in the WEEX $50,000 Warden airdrop before Feb.11, 2026!

WEEX vs Other Exchanges: 2026 Liquidity and Fees Comparison - Which is Best?

Unlike many exchanges that struggle with fragmented liquidity pools, WEEX has implemented strategic partnerships with institutional market makers and maintains deep liquidity reserves across all major trading pairs. The platform's 1700+ supported assets aren't just listed—they're actively traded with institutional-grade depth that ensures consistent execution quality.

What Is Copy Trading? Your Complete Guide to Getting Started in Crypto

Copy trading has surged in popularity within the crypto world, especially as platforms like WEEX integrate it seamlessly…

How Does an ETF Work? Your Essential Guide to Exchange-Traded Funds in Crypto and Beyond

Exchange-traded funds, or ETFs, have surged in popularity lately, especially with the 2024 approvals of spot Bitcoin ETFs…

Earn

Earn